Author: Abhishek Garg LinkedIn Instagram

India's economic rise is undeniable. Its GDP has skyrocketed from $485 billion in 2001 to a staggering $3.15 trillion in 2021, a remarkable 551.34% increase. However, a closer look at the distribution of this growth reveals a troubling trend:the gap between rich and poor is widening at an alarming rate. Reference

A Tale of Two Indias

While the overall economy has flourished, the benefits haven't been shared equally. Data from the World Inequality Lab [Reference] paints a concerning picture:

- The top 10% of earners in India captured an increasingly larger share of the national income. Their share grew from 40.9% in 2001 to a staggering 57% in 2021, a jump of 39.36%.

- Conversely, the bottom 50% of earners saw their share of the national income dwindle from 20.2% in 2001 to a mere 15.4% in 2021, a decline of 23.76%.

Deceptive Averages

At first glance, the average GDP growth rate of 9.81% between 2001 and 2021 might seem positive for all income segments. But a deeper dive reveals a crucial detail: the growth rate wasn't uniform.

- The top 10% saw their income grow at an average rate of 11.64%, significantly higher than the national average.

- The bottom 50%, however, experienced a slower growth rate of only 8.33%

The Power of 3.31%

This seemingly small difference of 3.31% in growth rates has had a dramatic impact. Over two decades, it caused a significant redistribution of wealth, enriching the top earners at the expense of the most vulnerable

The Fallacy of Inflation-Adjusted Growth

Even this 8.33% growth for the bottom 50% might be misleading. A significant portion of this growth could simply be due to inflation. In simpler terms, the bottom 50% might be earning more rupees, but their purchasing power hasn't necessarily increased. Their income might only be keeping pace with rising prices of essential goods.

Limited Investment Opportunities

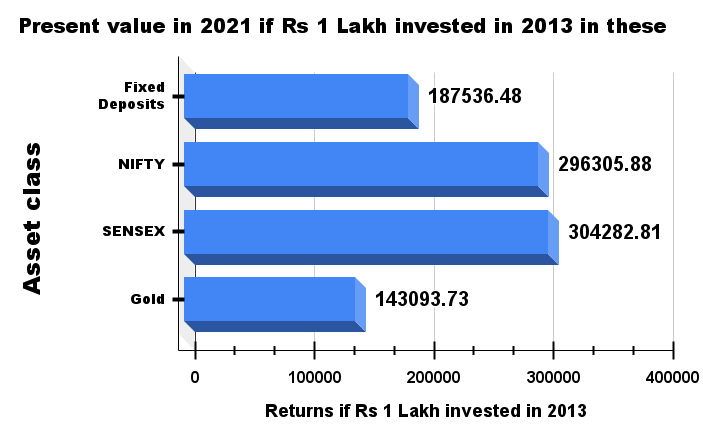

Furthermore, traditional investment options like Fixed Deposits (FDs) and Employee Provident Fund (EPF) offer returns of around 6-8%. While seemingly stable, these returns struggle to keep pace with inflation in the long run. This limits the ability of the bottom 50% to accumulate wealth and truly benefit from economic growth.

The Investment Divide

In contrast, the top 10% often have access to a wider range of investment options like equities and mutual funds, which have historically offered higher returns. This allows them to grow their wealth at a much faster pace, further widening the gap.

Course Correction: Bridging the Gap for Real

India's economic success story cannot be complete without addressing this widening inequality. Here are some crucial steps to consider:

- Promoting financial literacy for the bottom 50%: Equipping them with the knowledge to explore alternative investment options beyond FDs and EPFs can empower them to build wealth more effectively. RBI report "Target college students for early adoption"

- Encouraging micro-investments: Creating a framework for micro-investments in the stock market with lower entry barriers can help the bottom 50% participate in potentially higher returns. "Weekly SIP to reduce the ticket size for daily workers."

- Focus on real income growth: Policies that address inflation and ensure wages rise faster than the cost of living can create a more meaningful increase in purchasing power for the bottom 50%. "Framework to define minimum annual wage increments to ensure real growth"

- Skill development programs with employability focus: Training programs that equip people with skills in high-demand sectors can open doors to better-paying jobs. "Focus on skills suitable for rural India to drive uniform growth"

- Education reform with an eye on the future: Modernizing the education system to focus on critical thinking,problem-solving, and adaptability will prepare future generations to thrive in the ever-evolving job market. "Industry collaboration for real world exposure

Conclusion

India's economic potential is immense. By focusing on policies that bridge the income gap, create a more inclusive investment landscape, and promote real income growth, India can create a future where prosperity is shared by all, not just a privileged few.

Let's Talk

Income inequality is a complex issue. Share your thoughts and ideas in the comments below. How can we bridge the gap and ensure that everyone benefits from India's economic growth?